ARTICLE

Gifting Closely Held Stock to Charity

This strategy could enhance your charitable impact while eliminating your capital gains tax and reducing your taxable income. The key to a successful gift is upfront preparation.

What to Consider When Gifting Closely Held Stock

Whether you’re a business owner, or an inner-circle executive, you probably already know the benefits of closely held stock: it gives those who run the company more control over decision-making, while allowing for the possibility of an advantageous tax situation. It has likely served you well over many years.

However, as you consider your exit strategy, you’ve probably also noticed a marked downside: closely held stock is relatively illiquid and difficult to value accurately. While these hurdles will still exist when you choose to donate the stock, you may find the benefits make it worth the effort.

The Upside of Gifting Closely Held Stock

You eliminate your capital gains tax. Like any gift of stock to a registered non-profit, you should avoid capital gains tax entirely, provided you make a gift of the stock itself (and not the proceeds from a sale of the stock). Especially if you’ve seen your business grow in value immensely, this can be a powerful tool to reduce your tax bill.

You could reduce your taxable income in the gifting year. If your business is registered as an S-corp, you could likely also deduct the gift value of the closely held stock from your personal income for that tax year. That may reduce your tax bill even further.

You enhance your charitable impact. By capturing tax advantages as part of the gift, you’re able to gift more than if you had sold the stock, paid taxes and gifted the remainder—this means extending your impact on causes you care about.

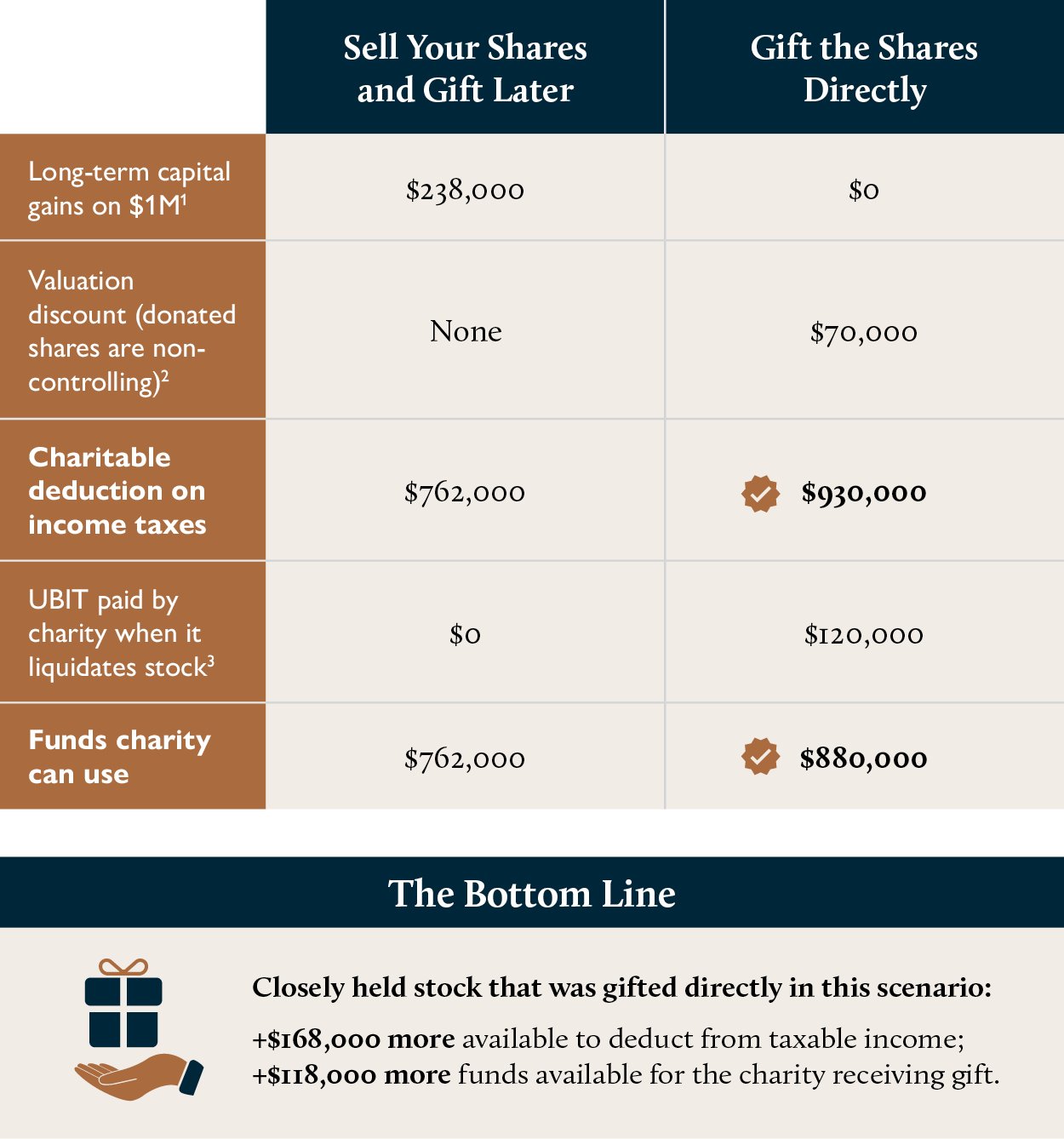

Closely Held Stock: Gifting Comparison

Example: Someone has $1M in closely held stock they would like to use for philanthropic purposes. Since they have been with the company since its founding, their cost basis is zero.

For illustrative purposes only. This is not tax advice; please contact your tax advisor about your specific situation. 1Assumes maximum long-term federal capital gains tax of 20% and Medicare surtax of 3.8%. 2Estimated 7% valuation discount in this scenario. 3Estimated 12% Unrelated Business Income Tax for non-profit in this scenario.

Steps for Smooth Gifting of Closely Held Stock

Prepare early and talk with your advisor. Any time you’re making big decisions on your business or financial life, it pays to review your options first.

“We occasionally have clients call us after a major transaction, where they want to gift the proceeds of a stock sale,” said Jenny Johnson, Philanthropy Services Director at 1834. “By looping us in so late, they’ve missed an opportunity for additional tax advantages.”

This is especially true when considering a relatively illiquid asset like closely held stock. You’ll want to think well in advance, possibly up to a year or two, so you can give yourself the best opportunity to maximize your goals.

Talk to the other owners in your business. This includes reviewing your company’s bylaws. For example, the other shareholders may have a buy-sell agreement, or they may have the right of first refusal on a possible sale; either would complicate gifting.

Even if you’re able to gift your shares free and clear, you’re creating an unknown for your long-time business partners. That merits in-depth discussions that may result in fruitful outcomes: for example, your partners may decide to purchase your share of the business from the charity where you plan to gift it.

Remember succession and estate planning. Your closely held stock is likely a decent portion of your estate. If your successors had anticipated receiving it as part of their inheritance, it pays to telegraph your decision now, so they have time to adjust.

Value the stock appropriately. Unlike a publicly traded stock, determining the value of your shares may be challenging, since there are likely few situations comparable to yours. Nevertheless, you’ll need to get a ”qualified appraisal.” This is not just so that it’s certified for your charitable donation; you also want to give the receiving charity an accurate understanding of what they’re getting. Work closely with your lawyer and accountant.

Find a charity that will accept closely held stock. While the value of your closely held stock may be obvious to you, not all non-profits will necessarily want it or be able to accept it.

“Smaller organizations, like your local food bank, might turn down closely held stock because they won’t have the resources to accept and liquidate the asset,” said Johnson.

Even larger organizations will want to have a plan for converting the stock into funds before they accept the gift. When searching for appropriate gifting partners, look for large, well-resourced organizations that have the experience and expertise to handle complex gifts. Some examples include national non-profits, large universities, and well-known advocacy groups.

Consider a Donor Advised Fund (DAF). If you don’t have one already, a DAF can often be opened through your wealth advisory firm. It’s a charitable investment account that allows you to receive the tax advantages of a contribution immediately, while then distributing the funds to registered non-profits at a more leisurely place.

DAFs that are created through larger wealth advisory firms, such as 1834, will have the resources necessary to convert your gift to liquid assets, like common stock or cash.

“A Donor Advised Fund can be a very useful tool,” said Johnson. “Once the DAF converts the closely held stock you donated to cash, you can then turn around and donate the proceeds to the small food pantry in your neighborhood that might not have been able to initially accept your closely held stock.”

Especially if you’re considering further charitable donations as part of your legacy, opening a DAF may make a lot of sense.

1834 Can Help with Your Philanthropic Plans

As a business owner, you already have a large impact on your community. Developing a legacy that includes a substantial philanthropic component can extend that impact to future generations—and further causes you care about.

At 1834, we’re happy to talk though your gifting opportunities and develop a comprehensive plan for building your charitable impact as part of your overall wealth plan. Reach out to get started.